Everything You Need to Know About Net Worth

What is Net Worth?

Net means

Remaining after the deduction of all charges, outlay, or loss.

- Merriam-Webster Dictionary

Worth is the value given to an item. For personal finance purposes, Net Worth is assets minus liabilities. Net Worth is a good way to determine and track the progress of how you’re doing financially. You can also use it to set goals depending on how much you want your Net Worth to be in the future.

Assets

Assets are anything you own that has real value. If you own a house that’s most likely your most expensive asset. Some other assets include vehicles such as planes, trains, and automobiles. Or more commonly cars, boats, motorcycles, quads, etc... Also included in assets are stocks, bonds, ETFs, cryptocurrency, and cash. Then if you have any collections of jewelry, Pokémon cards, or stamps those could be considered assets if the market value is over $500. Furniture and pets are not assets.

Liquid Assets

Any asset you own can easily be converted into cash. Ex:

Stocks

Bonds (short term)

ETF

Illiquid Assets

Any asset you own that would take a while to convert into cash. Ex:

GICs (long term)

Bonds (long term)

Real estate

Illiquid assets should never be part of your emergency fund.

Liabilities

Liabilities are any amount of money you owe to companies, governments, or other people. This is also how much debt you have. A mortgage is considered a good liability if the value of the house is going up over time. Ex:

Mortgages

Car loans

Student Loans

Credit cards

Rent payments

How to Calculate Your Net Worth

Calculating your Net Worth is simple. You add up all your assets and subtract all your liabilities.

For a house, your house value is the asset and the mortgage amount remaining is the liability. It is possible to have a negative Net Worth. That’s pretty common when you first graduate from university or buy a house. But you want to work to eliminate bad debt or liabilities that charge you high interest using efficient budgeting. Also, see my budgeting page to learn about Mint and Wealthica that calculate and keep track of your Net Worth for you.

What Should Your Net Worth Be?

Your actual Net Worth number depends on your age and retirement goals. If you’re striving for FIRE you will have you increase your Net Worth much faster than someone who is planning to retire at 65. Below are charts based on the average and median single persons Net Worth.

Average/Median Net Worth in Canada by Age (2019)

Chart using Statistics Canada Data

Average/Median Net Worth in the US by Age (2019)

Chart using The Federal Reserve Data

These charts should give you an idea of where you stack up.

Observations

I believe the average Net Worth is skewed toward the high side because of all the Millionaires and Billionaires in Canada and the US. The median is a more justified value to use. These values are most similar between the US and Canada. The median value for those over the age of 65 does not look like enough money to live off. Keep in mind these values include your house which usually can’t be used to pay the bill while you’re living in it.

These median values are very low compared to what a person needs to retire. Let’s try the 4% rule and use the median Net Worth for a Canadian over the age of 65 of $322,300. Using the 4% rule that’s $12,892 a year. Almost no one could live off that little. In reality, there are programs like the Canada pension plan and old-age social security that might help you retire in more comfort if you can wait till you’re 65. See programs and services for seniors here. In the US they also have U.S. Social Security.

From the charts, it looks like Canadians start investing more earlier and gradually. Whereas Americans invest less at first then start investing much more aggressively later in life.

How to Increase Your Net Worth

Your Net Worth will change based on your life stage and market performance. That’s expected, but here’s a list of things you can control to increase your Net Worth:

Not too surprising these methods line up well with FIRE. The younger you are when you start investing the better because of the magic of compound interest. See the rule of 72 to learn how your investments double overtime. If you make good financial decisions you can become wealthy over time.

My Net Worth

Here I will show you the breakdown of my assets versus liabilities.

My Assets

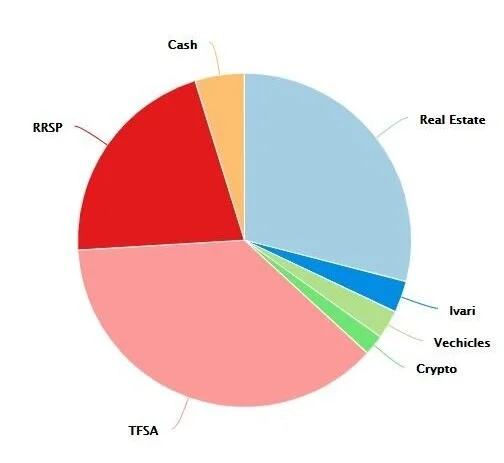

I have 7 contributors to my assets. As you can see from the chart below investments are my biggest contributor and my car is the least. A car is a depreciating asset so it loses value over time.

Asset Contributions to Net Worth

Graph generated from Wealthica

My Liabilities

My only liabilities are my mortgage and credit card debt which I pay off the full balance of every month. See my credit card page for some helpful tips.

Asset vs Liabilities Contribution to Net Worth

This is my July 10th 2021 Net Worth breakdown. As you can see from the charts I have a positive Net Worth. Because most of my liabilities are from my mortgage I am paying down the principle each month and reducing that debt. Meanwhile, my investment are fluctuating day to day but growing over time. In the last 6 months my Net Worth increased by 19.90% as measured using Wealthica.

I hope this article helps you understand and improve your Net Worth.